The Greatest Guide To Maw Your Realtor

Some Known Questions About Maw Your Realtor.

Table of ContentsMaw Your Realtor Fundamentals ExplainedA Biased View of Maw Your RealtorMaw Your Realtor Fundamentals ExplainedSome Known Details About Maw Your Realtor

For contrast, Wealthfront's average portfolio gained just under 8% internet of fees over the past 8 years. And the Wealthfront return is much more tax reliable than the return you would get on actual estate due to the method rewards on your Wealthfront portfolio are tired and also our tax-loss harvesting.1% return, you need to have a nose for the communities that are most likely to appreciate most quickly and/or discover a terribly mispriced building to buy (into which you can spend a tiny amount of money as well as upgrade right into something that can regulate a much greater rent even better if you can do the job on your own, yet you require to make sure you are being effectively made up for that time).

And we're talking regarding individuals that have huge teams to help them find the perfect residential property and also make improvements. It's better to diversify your investments You ought to think about investing in a private residential or commercial property similarly you should believe regarding an investment in an individual supply: as a large risk.

The suggestion of trying to choose the "right" individual residential or commercial property is appealing, particularly when you believe you can get a bargain or buy it with a great deal of leverage. That strategy can function well in an up market. Nonetheless, 2008 showed everyone regarding the risks of an undiversified realty profile, and also advised us that take advantage of can work both means.

The Main Principles Of Maw Your Realtor

Liquidity matters The last significant argument versus owning financial investment properties is liquidity - maw your realtor. Unlike a property index fund, you can not sell your building whenever you want. It can be tough to predict how much time it will certainly consider a domestic building to sell (as well as it frequently really feels like the more excited you are to market, the longer it takes).

Trying to make 3% to 5% even more than you would on your index fund is practically difficult besides a handful of realty exclusive equity investors who bring in the very best and the brightest to do only concentrate on outmatching the market. Do you truly believe you can do it when professionals can't? Our suggestions on rental home investing is regular with what we recommend on other non-index financial investments like supply selecting and angel investing: if you're going to do it, treat it as your "play money" as well as restrict it to 10% of your fluid net worth (as find more information we discuss in Measuring Your House As A Financial investment, you need to not treat your residence as an investment, so you don't have to limit your equity in it to 10% of your liquid net worth).

If you have a home that rents for much less than your lugging expense, then I would highly advise you to consider marketing the building as well as instead spend in a diversified portfolio of low-priced index funds.

For many years, genuine estate financial investment has actually continuously increased. Some people choose to acquire a home to rent out on a lasting basis, while others opt for temporary leasings for tourists as well as business vacationers. One area that has actually seen substantial development in genuine estate financial investment is Las Vegas. From homes, single-family houses, and also penthouses to industrial workplaces and retail rooms, the city has a wide array of residential or commercial properties for budding capitalists.

The Main Principles Of Maw Your Realtor

Is Las Vegas real estate a great investment? Let's check out! Why Las Las Vega is an Excellent Area to Purchase Realty, A great deal of individuals are transferring to Las Vegas whether it's due to the fact that of the remarkable weather condition, no income tax obligations, and a great expense of living. That's why the city is continually ending up being get more a leading realty financial investment destination.

Between the infamous Strip, the wealth of resorts, hotels, and casinos, world-class amusement, amazing interior attractions, as well as amazing outside spots, individuals will constantly be attracted to the city. This means you're never ever brief of site visitors looking for a location to remain for a weekend break journey, a long-term service, or a residence to transfer to.

In A Similar Way, Las Las vega is known for its service conventions as well as trade convention that it holds every year. These generate organization basics travelers and also entrepreneurs from all strolls of life that, once more, will be trying to find somewhere to remain. Having a realty property in the area will certainly be helpful for them and also earn returns for you.

Our Maw Your Realtor Statements

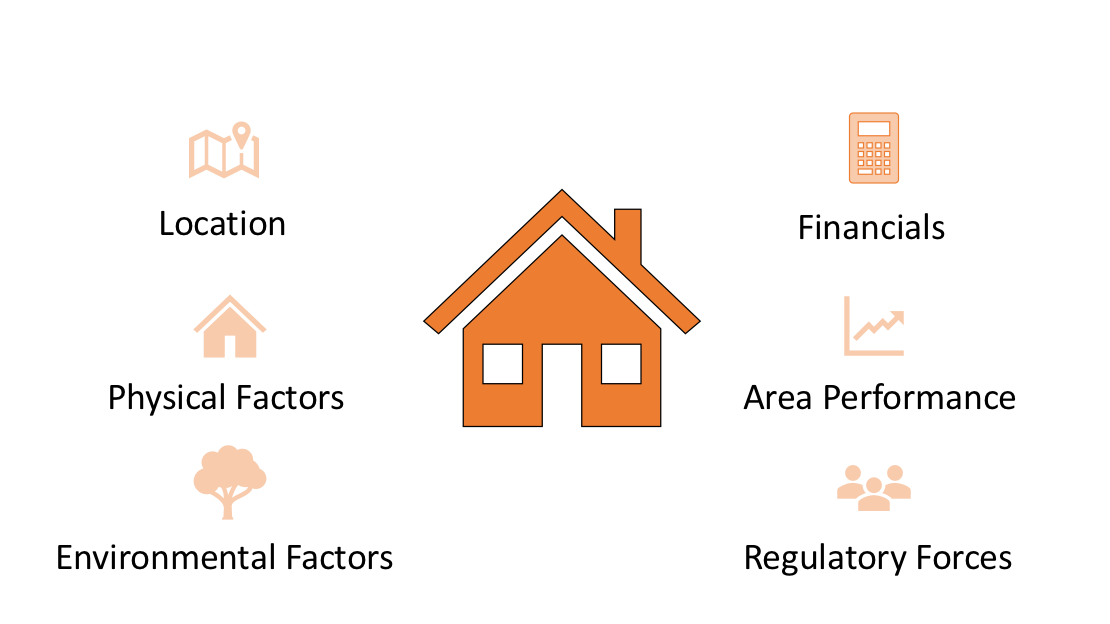

Type of Residential Property and its Features, It's important to recognize what sort of property property you wish to purchase commercial, industrial, domestic, or retail. Residential involves residences, a basic human demand, so this investment is known to be the safest with guaranteed returns. The other 3 tend to have high dangers (such as financial decline as well as vacancies), but they offer higher earnings margins.

Speak with the local government or companies in fee of city preparation and zoning. They can give you an idea of what remains in store in the area, so you can much better analyze if this is an excellent financial investment. 3. Home Value, Understanding the approximated value of the residential or commercial property beforehand assists you make a decision whether or not the financial investment is worth it. maw your realtor.